|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding FHA Streamline Refinance Loan Limits and MoreThe FHA Streamline Refinance is a popular option for homeowners looking to refinance their mortgages efficiently. However, understanding the loan limits and other aspects is crucial to maximizing its benefits. What is FHA Streamline Refinance?The FHA Streamline Refinance is designed to help homeowners reduce their interest rates without the extensive documentation usually required in traditional refinancing. This program allows borrowers to take advantage of lower interest rates, such as those available through 30 year mortgage refinance rates today. Eligibility RequirementsTo qualify for an FHA Streamline Refinance, certain conditions must be met:

Understanding Loan LimitsLoan limits for FHA Streamline Refinance vary by location and property type. It's important to note that these limits are set annually and can change based on housing market conditions. Why Loan Limits MatterLoan limits impact the amount of money that can be borrowed without requiring additional qualification processes. Exceeding these limits might require more documentation or a different refinancing approach. Common Mistakes to AvoidWhen considering an FHA Streamline Refinance, avoid these common pitfalls:

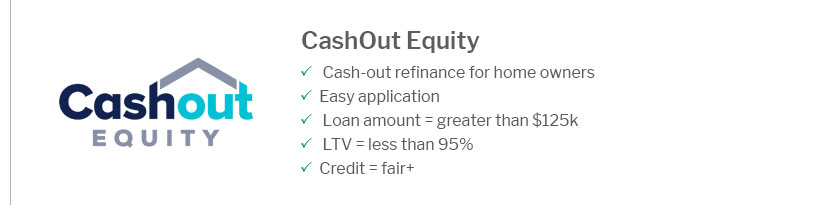

FAQs About FHA Streamline RefinanceWhat are the benefits of an FHA Streamline Refinance?The main benefits include reduced interest rates, no appraisal requirement, and limited documentation, making it a quick and efficient way to refinance. Are there any drawbacks?While the process is streamlined, the costs associated with refinancing may outweigh the benefits if the interest rate reduction is minimal. Can I use an FHA Streamline Refinance to cash out equity?No, the FHA Streamline Refinance does not allow for cash-out refinancing. It's primarily aimed at reducing interest rates and monthly payments. Understanding these elements can ensure you make informed decisions and fully benefit from an FHA Streamline Refinance. https://www.hud.gov/sites/documents/4155-1_3_SECC.PDF

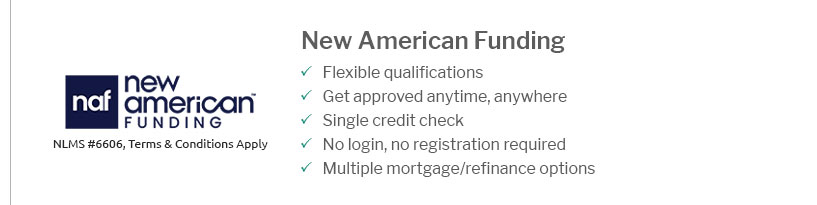

policy on subordinate financing on streamline refinances. ... maximum CLTV is calculated by taking the original FHA base loan amount. https://www.newamericanfunding.com/learning-center/homebuyers/fha-loan-limits-2024-updated-guidelines-and-requirements/

The FHA maximum loan amounts for 2024 vary depending on the county and property type. The maximum amount for a single-family home in a low-cost ... https://themortgagereports.com/27779/fha-loan-limits-mortgage-rates-interest

The current multifamily property FHA loan limit for most of the United States is as follows: $671,200 for two-unit, for $811,275 three-unit, and ...

|

|---|